Why clean energy needs financial engineering

Plus: Hydrogen pipelines, Advanced Market Commitments, and what made solar energy cheap

Welcome to The Joule Thief

Energy is upstream of everything. It's only a slight exaggeration to say that the physical economy consists of digging crap out of the ground, zapping it or heating it up in a certain way, reassembling it, and moving it to someplace else where it’s used. Basically every part of that process is changing, partly to stop us from smothering ourselves to death in carbon dioxide, but for lots of other interesting reasons too. The Joule Thief will try to tease out the implications of these changes and the underlying dynamics driving them.

More concretely, TJT will tackle one clean energy topic per week plus a potpourri of other nuggets interesting or amusing to yours truly. Style-wise, we're aiming for something like (*gulps*) The Diff, Emerging (gone too soon, but not forgotten; ht to Rawson for the pen name), or Stratechery.

Topics I'm hoping to cover eventually include:

The clean energy commodities supercycle and new energy geopolitics

Fossil energy and the global food supply

Clean energy and industrial strategy

Europe's attempts to wean itself off of fossil gas

Learning curves and why we're so bad at them

How to think about California

Clean energy, deflation, and secular stagnation

Today, the case for more financial innovation in clean energy.

Embracing clean energy’s financial innovation roots

Two reasons to be pessimistic about a timely clean energy transition are:

The sheer amount of investment in raw-$ terms that is needed to build all the infrastructure we need to hit any of our goals. Hitting net-zero-by-2050 levels of investment (in the trillions, by most estimates)1 requires mega-$ capital allocators (think CalPers, not Kleiner) ploughing money into (nearly) New-Deal-scale infrastructure build-out to decarbonize electricity, industry, and transportation

Very few investors are familiar/comfortable with the return profile of clean energy investments. Global investment in clean tech is at an all-time high of ~$500B globally, but nowhere near what’s needed and digging into the numbers even slightly tells you that it’s practically all for wind and solar deployments and EVs (important/necessary, but insufficient for full decarbonization.)

So why don’t investors want to get in on the action? The short answer is they can’t find non-solar/wind/EV projects that offer them the risk/return that they’re looking for. That’s true, but a little tautological. Like saying nobody wants to go on a date with me because I don’t seem like dating material.

The longer answer comes down partly to a problem with innovative clean energy projects (CapEx intensive, subject to higher-than-average policy, commodity volatility, technology, and execution risk), but partly to the *under-financialization* of ClimateTech. These issues are related.

On the inherent challenges for clean energy projects: oversimplifying monstrously, clean energy technology requires big CapEx outlays today for low or next-to-no OpEx for decades. The classic example here is a solar plant versus a coal plant. Practically all the cost of a solar plant is in buying and setting up the panels (vs. a 1 GW coal plant, which needs over 3 million tons of coal for fuel *every year*.) After that initial slug of upfront cost, generating electricity from the solar plant is practically free. This same dynamic is replicated across several clean energy technologies. Geothermal power plants, nuclear, batteries, electrolyzers, energy efficient appliances, and EVs are all higher CapEx and lower OpEx than their fossil-based corollaries.2 This is why finance is so important to clean energy—it’s the way we teleport those future OpEx savings through time and space to cover those higher upfront costs.3

From Dawson 2017 (h/t to Brian Potter at Construction Physics)

But it takes a long time for investors to get comfortable enough to perform that magic teleportation. They need to be pretty sure that those future cashflows and savings (plus a little profit) will actually materialize if they pony up the money today. The way this worked for solar and wind was that

1) utilities (which tend to have excellent credit since a lot of them are quasi-governmental entities) promised to buy the electricity from wind and solar plants and banks financed against those revenues,

2) specialized project structures developed to take advantage of wind and solar’s respective federal tax credits, and

3) plummeting costs made these deals more and more attractive to a broader swath of buyers, so it was worth bankers and investors’ time to figure out how to finance them.

But figuring out how to finance solar and wind projects at scale took decades. It needs to happen much faster for other technologies to have a shot at achieving climate targets. Right now, it’s not happening as fast as it needs to.

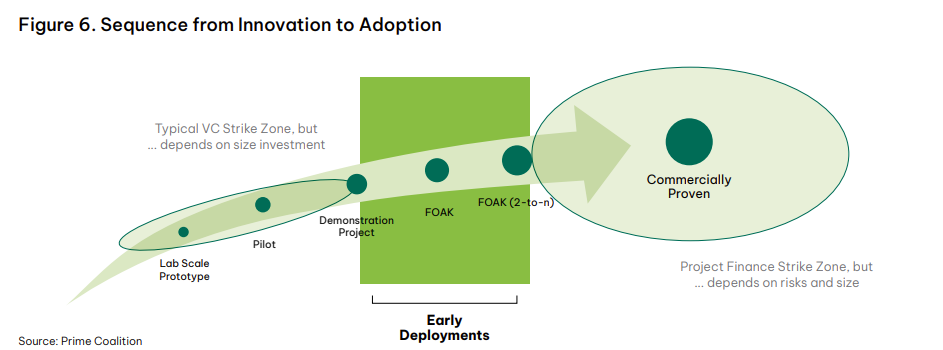

This leads us to the second part of our longer answer: underfinancialization of the clean energy space. The better-known aspect of this is the “valley of death” for ClimateTech, which is a jargon-y way of saying that nobody wants to pay for the comparatively high-risk, low-return work of scaling up a money-losing pilot/prototype into something that actually makes money.

Source: Prime Coalition

There are three ways to bridge this gap:

Free or very cheap money, usually from the government, to fund “early deployment” projects. The money in the infrastructure bill for hydrogen (~$8B) and Direct Air Capture (~$3.5B) are an example of this sort of funding

Standard vocabulary to describe the pilot-to-commercialization process. The Prime Coalition (link) makes an interesting argument that a standardized and broadly recognized framework to describe the path to commercialization (like pharma has for drug development) would help companies find the capital they need. Drug development is expensive, has a long timeline, and is pretty high-risk but there is plenty of money to fund drug development and there’s a very broadly accepted vocabulary (partially imposed by the FDA trial process) to make sense of the process. (The outsized returns from a new drug’s exclusivity at the end of development helps a lot here; clean energy doesn’t enjoy this outsized pay-out at the end of the process.) Some of this is happening already—just in the past few years “demonstration” and “First-of-a-kind (FOAK) deployment” have become standard (if sloppily applied) ways to describe where clean energy technologies are.

Financial innovation to fill funding gaps. Debt financing likes low risk and will accept low returns in exchange. Equity financing likes high returns and will accept higher risk in exchange. The problem for the valley-of-death funding is that it is high risk and low return.

Source: Prime Coalition

This could easily be the end of the conversation. Investors exist along a risk/reward continuum with venture capital on one end and project debt on the other and if a project falls outside of that (e.g., if returns are incommensurate with risk) then it will understandably have trouble getting funding. But we’re seeing the green shoots of some ways around this. As blunt an instrument as ESG investing is, it has lowered cost of capital for clean energy technologies. Companies like Atmos Financial are doing something similar, letting consumers funnel their capital to clean energy to drive down cost of capital for those projects. Even crypto, for all the (often-deserved) ridicule it draws from clean energy types, has offered glimpses of what funding that doesn’t rely on the traditional debt/equity axis can look like.4 All of these are imperfect and in their infancy and aren’t unseating debt and equity anytime soon (Debt/equity are as lindy as it gets in finance.) But it would be dumb to sleep on them entirely. The more familiar type of financial innovation would look like packaging projects differently (maybe lumping demo and FOAK deployment into the same investment vehicle or giving investors in demos options for cheaper shares of subsequent commercial projects) or developing new commercial arrangements/business models for a given technology that has a more attractive risk/reward (e.g., voluntary advanced purchasing commitments for things like hydrogen-derived low-carbon steel.)

Of these options, it is financial innovation that is actually in the clean energy industry’s power to effect and that could dramatically speed up deployment timelines. Free money is great if you can get it, but largely depends on the whims of politicians or the ultra-rich. Standardization is feasible and already happening, but the impact it can actually have is marginal.

A lot of people are justifiably skeptical of financial innovation. Enron, subprime mortgage CDOs—financial innovation only really hits public consciousness when it gives rise to high-profile failures or bona fide fraud. But financial innovation is also the only reason we have the renewable energy successes we do: California’s ISO4 contract, Corporate Power Purchase Agreements, Renewable Energy Credits, partnership flips. Solar and wind wouldn’t have the insanely low cost of capital that they do if it weren’t for these financial innovations.

Technological progress and demand for decarbonization are more or less a given at this point. Whether we can actually turn over our electricity, transportation, and industrial base fast enough will depend more on whether the right financial tools are in place to funnel trillions of investment dollars to the task.

Petajoule pot-pourri:

Hydrogen pipelines

BNEF ($$$) has a good report out breaking down some of the economics of hydrogen transport, the takeaway of which is that transporting hydrogen will be more expensive than natural gas on an equivalent-energy basis. The Hydrogen Economy exists right now mostly in the hopes and imaginations of policymakers and developers and it is still far from clear whether hydrogen will be a centralized industry (making hydrogen in low-cost areas and shipping to points of end-use) or a distributed one (production happening adjacent to consumption.)

At the volume of hydrogen needed to minimize the cost of transport for a 600 mile pipeline (over 3 million tonnes per year vs. current total US hydrogen consumption of ~10 million tonnes per year) you get to $0.27/kg-H2, which is still 25% more expensive on an equivalent-energy basis versus natural gas. With these economics, it starts to be a bit of a dead-heat with things like on-site production of hydrogen (or converting hydrogen to ammonia before dropping it in a pipeline.) Probably the way this shakes out is a few isolated pipelines serving large, stationery hydrogen demand centers (West Texas to Houston is an obvious one) with more distributed production making up the remainder of the use cases.

Advanced market commitments

Climate Tech VC has a good interview with the First Mover’s Coalition (US State Department initiative led by John Kerry) announcement that they’ve reached ~$10B of pooled demand for low-carbon products. It’s an impressive accomplishment, but there’s still a long row to hoe to turn theses into the kind of Advanced Market Commitment that will actually stimulate new supply and capital investments in plants to produce low-carbon commodities. It’s non-trivial to turn high-level commitments from a bunch of consulting firms and tech cos into purchase agreements firm enough to justify a multi-billion dollar investment in a clean steel or cement plant. They’ll probably have the easiest job of it in CDR since the Frontier Fund has done a lot of the work for them.

What we’re reading:

How Solar Energy Became Cheap: A compelling explanation of why Solar power has become as cheap as it has, especially the idea that solar went down a “demand curve of niches” where small volumes of customers with a high willingness to pay funded enough deployment to bring the cost down such that they could access a slightly larger customer set with a slightly lower willingness to pay.

A lot of Nemet’s account is about globalization. In that 1) different countries (in order: the US, Japan, Germany, China) took on the mantle of solar leadership when it fell out of fashion in the last country 2) it was often the same people following the industry as its center of gravity shifted around the world and 3) easy international trade was what allowed the Chinese to build out solar manufacturing to take advantage of the outrageously high German solar subsidies. (The fact from the book that will stick with me longest: Germany’s solar tariffs were so rich that they came out to 20 euros per household per month. The 30 GW of PV the program paid for cost over 200 billion euros.)

There’s may be reasons to think deglobalization will benefit US decarbonization (the last time the US had policy consensus and a big science, technology, and infrastructure spending binge was when we were competing with the Soviets.) But more likely it will do to the clean energy industry what it will do to the rest of the economy: make it poorer and less dynamic on net.5

Energy meme of the week:

As a German Airbnb host I made very upset can attest (pre-Ukraine!), Americans do not really grock just how much more expensive gas is in Europe. (Slightly out of date, can promise fresher content next week.)

There’s sort of a fun cottage industry at this point of doing these huge modeling exercises that spit out some large, arbitrary-feeling trillion-dollar number for investment needed for net-zero, which you then have to defend against all the other large but also different trillion-scale estimates. (Some links here if you’re interested in it.)

There’s plenty of exceptions here as well. Anything that uses biomass as a feedstock, for instance.

“My elevator pitch for why anyone should care about finance: it is in the business of teleporting value through space and time, no more and no less. This is a stupendously useful capability for society to have, which is why substantially all societies place an immense deal of importance on it.” - Patio11

Poorer on net globally, but maybe more resilient and stable as isolated countries are insulated from global economic shocks and the US middle class benefits from some measure of reshoring. (Still too early to see if this reaction runs in reveres—automation could be the confounding variable here.)

Thanks. Looking forward to the next articles!